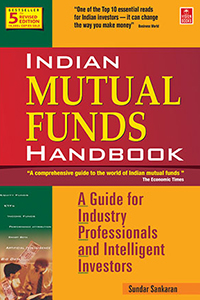

“A comprehensive guide to the world of Indian mutual funds, its operational and regulatory mechanisms, the advantages and limitations of investing in them, along with a practical approach to personal financial planning. It highlights the finer nuances. . . .”

The Economic Times

“From his experience as a trainer in strategic management and financial markets, Sundar Sankaran visits the subject of mutual funds in a nononsense manner . . . Indian Mutual Funds Handbook is ideal for investors looking for a deeper understanding of mutual funds . . . Sankaran simplifies concepts for the layman.”

Business World

“For those who are joining the mutual funds show, Sundar Sankaran hasjust the right book for you. . . . And Sundar is confident you’d make money in mutual funds.”

The Hindu Business Line

“The best book that I have come across for understanding mutual funds. Will be useful for employees of asset management companies, marketing intermediaries, investors and students — any one who wants insights into mutual funds in India.”

M. Subramanian, CEO India, Barclays Bank plc.

“The common sense approach to mutual funds makes interesting reading.”

C. Jayaram, Joint Managing Director, Kotak Mahindra Asset Management Co Ltd.

“I congratulate you for a genuine effort at demystification and to make understanding of mutual funds crisp and simple.”

P.G.R. Prasad, former Managing Director, SBI Funds Management Pvt Ltd.

“If you think you know everything about mutual funds, read the book to find out how much you do not know!”

Prof. G. Sethu, former Dean, UTI Institute of Capital Markets

“Very comprehensive. Covers every topic relating to the mutual fund industry in simple language.”

M.V. Suryanarayana, former Chief Executive, Jeevan Bima Sahayog Asset

Management Company Limited (Asset Manager for LIC Mutual Fund)

“An attempt to unfold various facets of mutual fund industry at a time when industry is poised for accelerated growth rate is a welcome move.”

Manubhai Parekh, former Managing Director, BOB Asset Mgt Co. Ltd.

“The chapter on financial planning may catalyse several new business models in mutual fund distribution.”

Niraj Chokshi & Jignesh Desai, Directors, NJ IndiaInvest

| Foreword to the Second Edition | 13 | |

| Foreword to the First Edition | 15 | |

| Preface to the Fifth Edition | 17 | |

| Acknowledgements | 19 | |

| Chapter 1: Introduction | 21 | |

|---|---|---|

| 1.1 | What is a Mutual Fund? | 22 |

| 1.2 | Who are the Parties Involved? | 23 |

| 1.3 | Capital Flow in the Economy | 26 |

| 1.4 | Corporate Governance | 26 |

| 1.5 | Schemes and Units | 26 |

| 1.6 | Net Asset Value (NAV) | 26 |

| 1.7 | Benefits of Investing in Mutual Funds | 27 |

| 1.8 | Limitations of Mutual Funds | 28 |

| 1.9 | Indian Mutual Fund Industry (Size) | 29 |

| Annexure 1.1: | Assets under Management (1965-2018) | 31 |

| Annexure 1.2: | Mutual Funds and Average AUM | 31 |

| Chapter 2: Mutual Fund Schemes and Comparable Products | 33 | |

| 2.1 | Types of Schemes by Tenor | 33 |

| 2.2 | Types of Schemes by Asset Class | 35 |

| 2.3 | Types of Schemes by Position Philosophy | 44 |

| 2.4 | Types of Schemes by Solution Orientation | 50 |

| 2.5 | Types of Schemes by Geography | 50 |

| 2.6 | Fund of Funds (FoF) Schemes | 52 |

| 2.7 | Schemes versus Options or Plans | 52 |

| 2.8 | Comparison with Other Products | 54 |

| 2.9 | Indian Mutual Fund Industry (Schemes) | 58 |

| Annexure 2.1: | Assets under Management (Category and Type-wise) | 60 |

| Annexure 2.2: | Distribution of Investor Accounts | 61 |

| Annexure 2.3: | Age-wise Analysis of Investor Accounts | 62 |

| Chapter 3: Legal Structure of Mutual Funds in India | 63 | |

| 3.1 | Sponsor | 63 |

| 3.2 | Trusteeship | 64 |

| 3.3 | Asset Management Company (AMC) | 68 |

| 3.4 | Maintenance of Investor Records | 71 |

| 3.5 | Unique Client Code | 72 |

| 3.6 | Custody of Investments | 72 |

| 3.7 | Setting up a Mutual Fund Operation | 72 |

| 3.8 | Change in Fundamental Attributes | 75 |

| 3.9 | Mergers and Acquisitions | 76 |

| 3.10 | Categorisation and Rationalisation of Mutual Fund Schemes | 81 |

| Chapter 4: Investments by Mutual Fund Schemes | 83 | |

| 4.1 | Types of Equity | 83 |

| 4.2 | Risks in Equity Investing | 88 |

| 4.3 | Value Drivers in Equity Market | 90 |

| 4.4 | Valuation of Equity Securities in Mutual Fund Schemes | 94 |

| 4.5 | Equity Investment Restrictions for Mutual Funds | 96 |

| 4.6 | Management of Equity Portfolio | 98 |

| 4.7 | Types of Debt | 101 |

| 4.8 | Risks in Debt Investing | 105 |

| 4.9 | Yield to Maturity and Price | 109 |

| 4.10 | Valuation of Debt Securities in Mutual Fund Schemes | 111 |

| 4.11 | Debt Investment Restrictions for Mutual Funds | 114 |

| 4.12 | Management of Debt Portfolio | 115 |

| 4.13 | Types of Derivatives | 117 |

| 4.14 | Investment in Derivatives by Mutual Funds | 117 |

| 4.15 | Gold | 119 |

| 4.16 | Real Estate | 120 |

| Chapter 5: Expenses, Net Asset Value and Loads | 122 | |

| 5.1 | Initial Issue Expense | 122 |

| 5.2 | Deferred Load | 122 |

| 5.3 | Net Asset Value | 123 |

| 5.4 | Recurring Expenses | 127 |

| 5.5 | Load and Its Implications | 130 |

| 5.6 | Profitability Metric | 131 |

| Chapter 6: Liability of Schemes | 133 | |

| 6.1 | Unit Capital Accounting | 133 |

| 6.2 | Management of Liquidity | 136 |

| Chapter 7: Offer Document, Key Information Memorandum and Advertising | 138 | |

| 7.1 | Scheme Information Document (SID) | 142 |

| 7.2 | Statement of Additional Information | 142 |

| 7.3 | Standard Observations | 143 |

| 7.4 | Key Information Memorandum | 144 |

| 7.5 | Extracts from Select Offer Documents | 144 |

| 7.6 | Advertising | 150 |

| Annexure 7.1: | Key Contents of SID | 153 |

| Annexure 7.2: | Key Contents of SAI | 161 |

| Annexure 7.3: | Format of Key Information Memorandum | 164 |

| Chapter 8: Financial Statements | 166 | |

| 8.1 | Asset Management Companies | 166 |

| 8.2 | Schemes | 168 |

| 8.3 | Disclosures and Other Commitments | 170 |

| Chapter 9: Scheme Comparison — Returns | 173 | |

| 9.1 | Absolute Returns | 173 |

| 9.2 | Relative Returns | 182 |

| Chapter 10: Scheme Comparison — Risk | 186 | |

|---|---|---|

| 10.1 | Quantitative Factors | 186 |

| 10.2 | Quantitative Factors Applicable Only to Debt | 204 |

| 10.3 | Qualitative Factors | 206 |

| Chapter 11: Scheme Comparison — Risk Adjusted Returns | 218 | |

| 11.1 | Sharpe Ratio | 224 |

| 11.2 | Treynor Ratio | 225 |

| 11.3 | Jensen Alpha | 226 |

| 11.4 | Eugene Fama | 228 |

| 11.5 | Appraisal Ratio | 229 |

| 11.6 | Modigliani and Modigliani (M2) | 229 |

| 11.7 | Sortino Ratio | 229 |

| 11.8 | Which is the Best Measure? | 230 |

| 11.9 | CRISIL’s Rating and Ranking | 231 |

| Chapter 12: Scheme Comparison — Investment Objective,Style Analysis and Other Factors | 233 | |

| 12.1 | Investment Objective | 233 |

| 12.2 | Investment Styles | 237 |

| 12.3 | Qualitative Factors | 242 |

| Chapter 13: Performance Attribution, Drivers and Smart Beta | 246 | |

| 13.1 | Performance Attribution | 246 |

| 13.2 | Alpha Drivers and Beta Drivers | 251 |

| 13.3 | Smart Beta | 253 |

| Chapter 14: Managing a Portfolio of Mutual Fund Schemes | 254 | |

| 14.1 | Risk Profiling | 254 |

| 14.2 | Asset Classes and Generic Risk | 256 |

| 14.3 | Asset Allocation | 259 |

| 14.4 | Scheme Selection | 263 |

| 14.5 | Exit from Schemes | 264 |

| 14.6 | Tips and Tricks | 265 |

| Chapter 15: Mechanics of Investing in Mutual Funds: KYC,KYD and Investor Empowerment | 267 | |

| 15.1 | Who Can Invest in Mutual Fund Schemes? | 267 |

| 15.2 | Investment by Qualified Foreign Investors (QFIs) | 268 |

| 15.3 | Investment by Foreign Portfolio Investors (FPIs) | 268 |

| 15.4 | Who cannot Invest in Mutual Fund Schemes? | 269 |

| 15.5 | Minimum Number of Investors | 269 |

| 15.6 | Know Your Customer (KYC) | 270 |

| 15.7 | Systematic Investment Plan (SIP), Systematic Withdrawal Plan (SWP) and Systematic Transfer Plan (STP) |

272 |

| 15.8 | Switches, Triggers and Dividend Transfer Plan (DTP) | 274 |

| 15.9 | Steps to Invest / Dis-invest Mutual Fund Units (Other than through Stock Exchange) | 275 |

| 15.10 | Steps to Invest / Dis-invest Mutual Fund Units (Through Stock Exchange) | 275 |

| 15.11 | Mutual Fund Utilities — The Aggregater | 276 |

| 15.12 | Cut-Off Time | 277 |

| 15.13 | Official Points of Acceptance | 279 |

| 15.14 | Post-Investment Servicing | 281 |

| 15.15 | Who Can Distribute Mutual Funds and Earn Brokerage | 282 |

| 15.16 | Know Your Distributor (KYD) | 283 |

| 15.17 | Brokerage, Commission and Transaction Charge | 286 |

| 15.18 | Supervision of Large Distributors | 287 |

| 15.19 | Investor Empowerment | 290 |

| Annexure 15.1: | SIP — NAV up 1% | 291 |

| Annexure 15.2: | SIP — NAV down 1% | 292 |

| Annexure 15.3: | SIP — Random | 293 |

| Chapter 16: Investor Protection | 294 | |

| 16.1 | Structural Protection | 294 |

| 16.2 | Role of AMFI | 294 |

| 16.3 | Rights of Unit Holders | 296 |

| 16.4 | Investor Relations Officer | 297 |

| 16.5 | SEBI | 298 |

| 16.6 | Implications Under Various Other Statutes | 298 |

| 16.7 | The Role of Press | 299 |

| Annexure 16.1: | Form for Nomination / Cancellation of Nomination | 300 |

| Chapter 17: Taxation | 302 | |

| 17.1 | Asset Management Companies | 302 |

| 17.2 | Mutual Fund | 302 |

| 17.3 | Schemes | 302 |

| 17.4 | Investors | 304 |

| 17.5 | Tax in Specific Situations | 314 |

| 17.6 | Tax in Summary | 318 |

| Chapter 18: Big Data, Artificial Intelligence, Block-chain and Mutual Funds | 320 | |

| 18.1 | Big Data | 320 |

| 18.2 | Artificial Intelligence | 322 |

| 18.3 | Block-chain | 324 |

| List of Abbreviations and Acronyms | 327 | |

| Glossary | 330 | |

| Further Learning | 334 | |

| Websites | 334 | |

| Journals | 334 | |

| References | 335 | |

| Index | 340 | |

Mutual funds can be a conundrum for people who are not closely associated with the industry. Even many who have been part of the industry for several years continue to have some misconceptions. This book aims to unravel some of the mysteries and clear the typical confusions I have noticed among participants in my workshops, and other people I interact with.

There are so many inter-linked concepts on the subject, that the sequencing of topics was a challenge. I hope my experience of handling several workshops has ensured a reader-friendly sequence. Readers can supplement the learning with my companion publication, Wealth Engine: Indian Financial Planning & Wealth Management Handbook [Vision Books, 2012]. Appropriate references to chapters in Wealth Engine have been provided at relevant places.

Readers who wish to understand the raison d’etre and mechanics of mutual funds, a powerful investment avenue, will treasure the book. Sequential reading is suggested for readers who lack a basic understanding of the product. Others can read the chapters in any sequence. Chapter 10 on risk, and to an extent Chapter 11, are a synthesis of advanced statistics and the financial markets. I hope the complex subject has been explained lucidly. Readers who are uncomfortable with advanced quantitative techniques can skip these chapters.

The subject of taxation is discussed in Chapter 17.*

Books, like people, need to evolve. The evolution continues, with the addition of content on Performance Attribution and Smart Beta. As with earlier editions of this book, I not only explain whatever exists in the Indian mutual funds arena, but also introduce concepts that will find their way in due course.

Needless to say, this book is not a recommendation to buy or sell any financial products. Some of the examples provided are illustrative. Kindly consult your investment advisor before taking any decisions related to your investment portfolio.

* This chapter has been updated with tax provision applicable in Assessment Year 2016-17.

The content in the book is updated till 1 October 2015. The mutual fund industry is dynamic. For a few months after the launch of the book, important subsequent changes will be highlighted at www.imfh.info. However, as suggested by my solicitor, I need to clarify that this is purely a gesture of goodwill. I retain the right to discontinue such updates any time — or offer such updates only as a paid service.

Happy reading! Happy investing! Happy living!

SUNDAR SANKARAN is founder-director of Advantage-India Consulting Pvt. Ltd (www.advantage-india.com) an 18-year old strategy consulting and knowledge incubation boutique. He has also founded finberry academy pvt ltd (www.finberry.org) and Stratberry Publishing

(www.stratberry.com).

Sundar is renowned as an effective trainer, who can simplify concepts, and catalyse learning through linkages with day-to-day examples. He operates with equal ease at macro-level perspective programs as well as micro-drill-down programs. His programs, which cover the entire range from leadership to product to selling, are not merely for knowledge dissemination; they seek to bring change within participants, so that they are enthusiastic about the desired behaviour.

Wide experience across geographies, markets and products have helped Sundar conceptualise several unique seminars and workshops, such as WealthEngine (www.WealthEngine.biz), EconoView (www.EconoView. biz), ThinkStrat (www.ThinkStrat.biz), AssetClass (www.AssetClass.biz)

PondSkill (www.pondskill.biz), Don’t Sell (www.Dont-Sell.biz) and MISCHIEF (www.mischief.biz).

Over the years, Sundar has trained over 20,000 participants across a range of innovative programs. Participants include:

- Mutual Funds — Kotak Mahindra, Fidelity, Standard Chartered, Canbank Tata, LIC, Unit Trust of India, SBI, HDFC, Optimix and BOB.

- Banks — Kotak Mahindra Bank, State Bank of India, ICICI Bank, HDFC Bank, Citi, Deutsche Bank, Standard Chartered Bank, ABN Amro Bank, Corporation Bank, Bank of Rajasthan, Bank of Baroda, Bank of India, Punjab National Bank and State Bank of Hyderabad.

- Other distributors — Kotak Securities, JM Morgan Stanley Distribution, ICICI Capital, Cholamandalam Distribution, NJ IndiaInvest, Birla Sunlife Distribution, Integrated Finance and Bajaj Capital.

- Press & Media — The Times of India, The Economic Times, Financial Express, Business Line, CNBC.

Sundar has worked in senior capacities at Bajaj Auto and Kotak Mahindra. His hands-on feel of financial markets and industry is well

complemented by his academic qualifications — Post-Graduate Diploma in Management from Indian Institute of Management, Ahmedabad (1988),

Associate of the Institute of Company Secretaries of India (1992) and Associate of the Institute of Cost Accountants of India (1988).

Sundar is active with various industry bodies. He is a member of the Banking & Finance Committee of the Indian Merchants’ Chamber.

His other passions include reading, Indian classical music and travel

“The book is available at Amazon, Flipkart and reputed book-stores all over India. You can also buy it from the publisher, Vision Books.

Further, you can access the e-book on Kindle, GooglePlay and AppleBooks (through iTunes).”